2019 Corn Outlook

Probing for Short Term Low

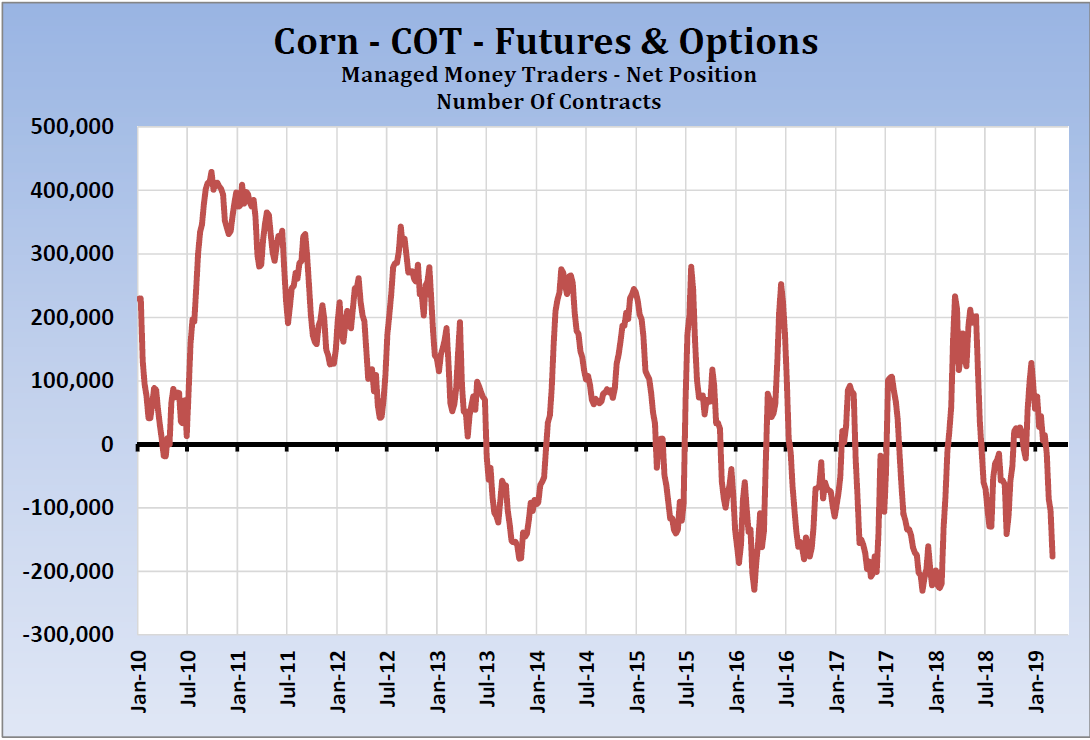

Funds Aggressive Sellers into Planting Season

May Need to Build a Weather Premium

The March USDA Supply & Demand report on March 8th was considered bearish for corn, with 2018/19 US ending stocks coming in at 1.835 billion bushels versus an average pre-report estimate of 1.751 billion and a range of expectations from 1.685 to 1.835 billion. Corn usage to make ethanol was revised down by 25 million bushels, and exports were revised down by 75 million bushels. These numbers may have been already accounted for in the price break ahead of the report, as corn closed near unchanged on the day of the report after trading down to contract lows. In the same report, 2018/19 world ending stocks came in at 308.5 million tonnes, below the average trade estimate of 309.9 million and down from the 309.8 million in reported in February.

The approach to the USDA Prospective Plantings report on March 29th and the shift in focus to the new crop season might help the market put in a floor, particularly if acreage comes in lower than expected. The market may feel the need to build a weather premium, if conditions continue to be cold and wet.

Scenarios for Tighter Supplies in 2019/20

The supply/demand table on presents a look at the 2019/20 season using the USDA Outlook Forum estimates that were released in February. We have adjusted the beginning stocks figure higher by 100 million bushels to reflect the changes from the March supply/demand update. Using a trendline yield, ending stocks would come in at 1.750 billion bushels, which would be a four year low.

If the cold and wet weather in the Midwest continues through late March and into April, actual plantings could come in below expectations. Other wet springs in the past ten years have resulted in planted area losses of 2 to 3.5 million acres.

If we assume a 2 million-acre loss in planted area, ending stocks could fall to 1.426 billion bushels, a six year low. This could result in the stocks/usage ratio dipping under 10% for the first time since the 2013/14 season.

Will China Buy US Corn?

A Bloomberg report on Friday, March 8th indicated that as part of the US/China trade negotiations, China is considering annual purchase commitments of at least 7 million tonnes of corn and some 3 million tonnes of ethanol. Nothing close to these levels is already accounted for in the USDA estimates.

Currently, the US is exporting roughly 60 million tonnes per year, so an additional 7 million tonnes would be significant. The ethanol purchase would be equivalent to 4 ½ weeks of total US production. This could send corn usage for ethanol higher and tighten stocks further.

If China were to buy 8 million tonnes of corn or ethanol equivalent from the US as part of the new trade deal, 2019/20 ending stocks could fall to 1.112 billion bushels, a seven year low, with the stocks/usage ratio dipping to 7.2%. This would be the tightest corn setup since 1995/96.

Funds Loaded Up on Short Side

The near-term technical set-up is very bearish, as fund traders continue to press the short side of the market. Fund traders have built up a huge net short position ahead of the planting season, and it may take a move back through key resistance levels to spark increased buying.

The Commitments of Traders report for the week ending March 5th showed managed money traders were net sellers of 72,318 contracts in just one week, bringing their net short position to 176,777. Commodity index traders sold 28,223 contracts for the week. The two groups combined were net sellers of 100,541 contracts in just one week. In four sessions after the data was collected, open interest increased approximately 73,000 contracts. This suggests that managed money traders have pushed their net short position well above 200,000 contracts and perhaps close to the record net short of 230,556.

Weather and/or purchases by China would be the most likely reasons for the market to rally. Key resistance levels for December Corn come in at $3.94 ¾, $3.98 ½, and $4.02. If these levels are penetrated, look for upside objectives of $4.25 ¼ and $4.39.

Download Full Report

You can download this full report with Trades by signing up for a free trial.