Next Week's Economic Focus - 2022.01.14

Take a Free Trial of our Daily Comments, Weekly Market Letter and more! Subscribe today or Learn More

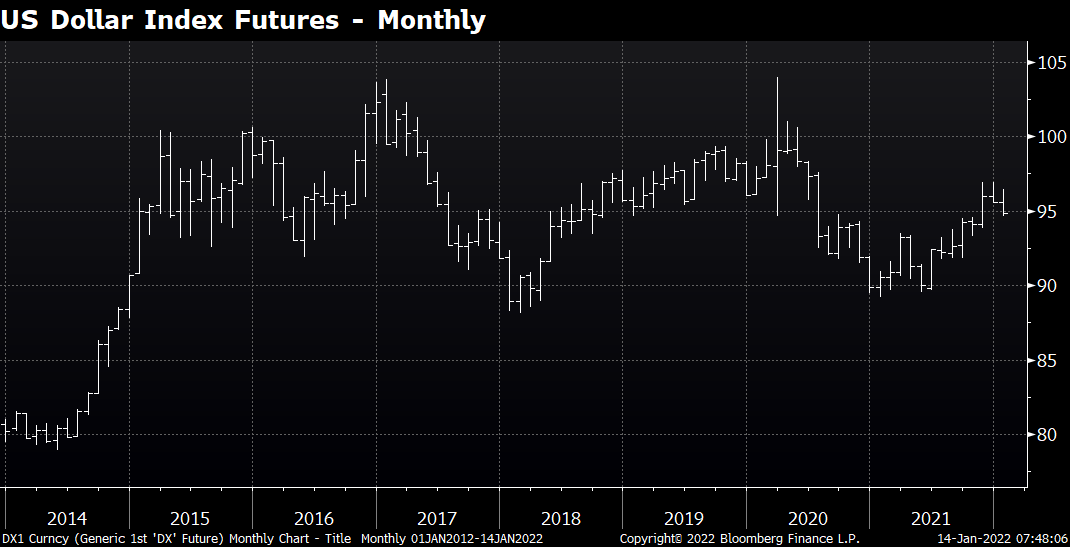

All things considered, commodity and equity prices performed impressively in the face of patently bearish developments like a 1.4 million single-day US infection count, market expectations for a March rate hike, and disappointing initial claims and retail sales. On the other hand, several markets have continued to show the ability to “look through” the omicron surge, and an extension of soft data could push back the timing of a rate hike. Furthermore, significant weakness in the dollar has made US commodities more attractive to foreign buyers. While markets in general can be choppy and indecisive early in the year, adverse weather in South America, potential Russian military action against Ukraine, a changing interest rate environment, surging inflationary signals, and much better than expected demand for energy promise to keep volatility high and perhaps set trends for the year. Potential sanctions on Russia could influence a long list of physical commodities, and there have already been significant price increases for natural gas in Europe. Grain market volatility is likely because of smaller South American production. We could see significant volatility in the energy markets with a major blow off top ahead.