ENERGY: Temporary Short Covering but Demand Fears Remain in Place

Take a Free Trial of our Daily Comments, Weekly Market Letter and more! Subscribe today or Learn More

CRUDE OIL

While news that Beijing will attempt to Covid test 22 million citizens is obviously a threat against energy demand, crude oil pricing this morning has managed to reject initial selling pressure. However, the charts remain bearish and any real evidence of a lockdown order in Beijing could rekindle the washout. Another ongoing outside market pressure comes from the unrelenting rally in the dollar which makes the marginal supplier of the world (the US) relatively more expensive than foreign supply. Even though the markets have been aware of strategic petroleum releases from the IEA, seeing the physical supply began to flow in May reiterates efforts to tamp down prices. After the significant washout to start the new trading week yesterday, it is difficult to determine if slowing fears from higher rates, Covid news from China, a surging US dollar, or deflation (instead of inflation) chased the most longs from the market. However, many commodity markets have been presented with credible signs of softening demand and with the US Fed expected to follow through with the rate hike promise next week the fundamental path of least resistance is pointing down in crude oil. Even supply news has turned patently bearish this week with the US Energy Secretary suggesting US oil and gas production is rising, will continue to rise and can offset the current loss of Russian oil output of 1.5 million barrels per day. Yet another negative supply development came from predictions that some Libyan production will be restarted in the coming days. Furthermore, Russian supply continues to make news with 20 million barrels of Urals oil reportedly headed to Asia! However, Russian crude oil offloading in Norway has been met with protests and the largest Polish oil company has suggested it is ready for an EU ban of Russian energy. This week's Reuters poll projects crude oil stocks at the EIA to increase by 2.2 million barrels this week. Going forward, the $95.00 level in June crude oil offers thin support, with resistance today at even numbers of $100.00.

PRODUCT MARKETS

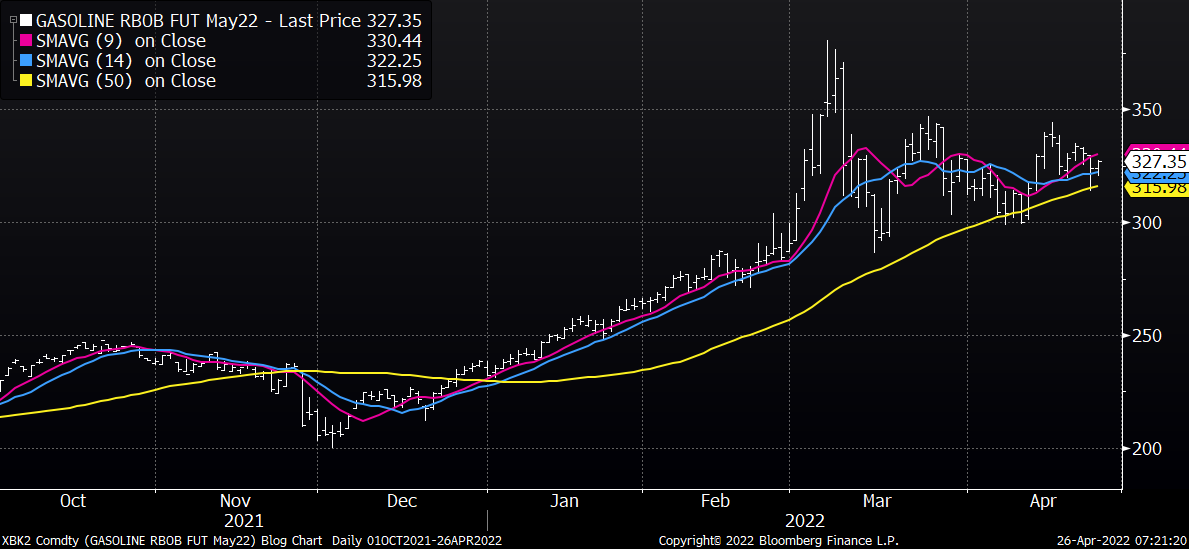

While gasoline has managed to reject a sub $3.20 trade in the June RBOB contract overnight, very strong profits from Valero in the first quarter suggests refinery activity in the US is picking up or that refinery margins are very rich and should prompt refining. Obviously, a lockdown order in Beijing (one the largest cities in the world) would immediately result in lower Chinese fuel consumption and that will likely result in an extension of the pattern of lower highs and lower lows in gasoline. While last week's US implied gasoline demand reading posted a new high relative to recent readings, extremely attractive crack margins should be spurring additional refinery activity. This week's Reuters survey pegs EIA gasoline stocks to rise by 500,000 barrels and predicts a 0.2% decline in the refinery operating rate. At least as of this writing, the weekly EIA report for gasoline could be neutral with the RBOB futures instead taking their guidance from the action in ULSD. While strong demand chatter continues in the global diesel market, overwhelmingly negative outside big picture market forces have put the longs back on their heels. However, the charts in the diesel market this morning are easily the most bullish of the complex and reports of strengthening European jet fuel demand adds to the upward bias. This week's Reuters poll projects distillate stocks to decline by 600,000 barrels.

PETROLEUM MARKET IDEAS

We leave the edge with the bear camp as there are too many negative outside market forces to list! Therefore, it is not surprising to see both supply and demand forces favoring the bear camp this week. However, the need for a modest technical bounce combined with very positive leadership from ULSD leaves the bull camp with a sliver of hope today. From a pure technical perspective, crude oil, gasoline, and diesel spec and fund long positions have likely been brought down significantly which should soon slow the rate of declines. However, until there is a definitive shift back into risk on or a fresh supply disruption, the bear camp holds serve.

NATURAL GAS

While the natural gas market has not tracked tightly with the petroleum markets, a big picture, broad based, macroeconomic deterioration leaves natural gas in a downward bias along with the petroleum markets. While the EU continues to struggle to agree to a total Russian ban, a major Polish company has indicated they are "ready" for a full ban! Furthermore, a Bloomberg production model has predicted Bakken Basin gas production fell by 12% on a day over day basis. Unfortunately for the bull camp, US weather has shifted bearish over the coming 2 weeks, the expiration of the May contract might be generating only temporary short covering buying and this week's Reuters poll projects EIA storage to build by 20 to 43 BCF. In a shorter-term negative, British wholesale gas prices for delivery in June declined by 13% on Monday! While we concede to bearish control, the $6.50 level has become very effective support, but the jury is still out on how solid support will be at the $7.00 level. However, US weather has shifted from bullish to neutral, reports are that Russian gas continues to flow under Ukraine and traders continue to worry that lockdowns in China will reduce upcoming LNG imports.