SOYBEANS: Soyoil Potential Key Reversal From All-Time High if Lower Close

Talk of impressive new crop export sales helped to support the market this week, and the turn higher in meal help support the gains overnight. A lower close today for soybean oil would represent a key reversal from an all-time high. For the monthly crush report, traders see soybean crush for March at 193.3 million bushels, 192-194.5 range, as compared with 188.2 million bushels last year. Given the low stocks number from NOPA, traders will monitor the oil stocks number closely. Traders see soybean oil stocks at 2.425 billion pounds, 2.4–2.44 range, as compared with 2.245 billion pounds last year. Soybean oil continued to surge higher and up to new all-time highs, but July meal closed sharply lower on the session yesterday and experienced the lowest close since February 1. Another surge higher in the US dollar which came close to a 20 year peak was seen as a negative factor. With very high crush margins, traders remain concerned that US, Brazil and Argentina are all crushing at a very fast pace, which could leave short-term supply of meal high.

Take a Free Trial of our Daily Comments, Weekly Market Letter and more! Subscribe today or Learn More

The Buenos Aries Grains Exchange indicated favorable harvest weather in the past week, with harvest reaching 46.4% complete, up 15.2% in a week. May soybean crush hit an all-time highs at $2.31 1/2. Argentina's crush is reportedly running well, with strong margins and good river levels allowing for easy movement of soybeans in and product out. Inverses are prompting crushers to run hard now and worry less about conserving soybeans for later when supplies are tight. The weekly export sales report showed that for the week ending April 21, net soybean sales came in at 481,317 tonnes for the current marketing year and 580,000 for the next marketing year for a total of 1,061,317. Of the total, China was 663,100 tonns. Cumulative soybean sales have reached 100.0% of the USDA forecast for the 2021/2022 marketing year versus a 5 year average of 95.7%. Net meal sales came in at 202,985 tonnes. Cumulative meal sales have reached 75.0% of the USDA forecast for the 2021/2022 marketing year versus a 5 year average of 78.6%. Sales need to average 139,000 tonnes per week to reach the USDA forecast. Net oil sales came in at 3,480 tonnes. Cumulative oil sales have reached 83.4% of the USDA forecast for the 2021/2022 marketing year versus a 5 year average of 74.7%.

MARKET IDEAS

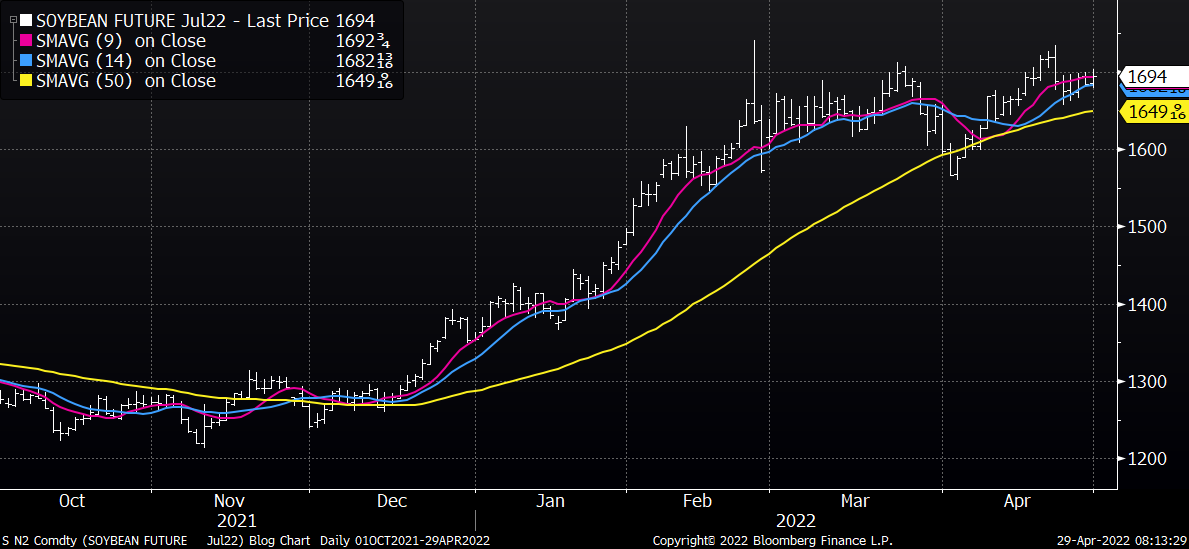

July soybean support comes in at 16.67 3/4 and 16.47 1/4, with 17.04 1/2 as near term resistance. A close through resistance would leave 17.63 1/2 as next upside target. November soybean key support is at 15.20 and 14.93 1/2, with 16.16 1/2 as a longer-term upside target. July meal experienced an inside trading session but the close near the lows, and near Wednesday's low looks a bit negative. If Wednesday's low cannot hold, 423.50 becomes the next key support. Resistance is at 443.0 and 448.40. A close through resistance would turn the charts bullish.